Like I worked for 5th 3rd from 2004 to 2010

Hmmm... I see a trend...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Like I worked for 5th 3rd from 2004 to 2010

We were told relentlessly, we can turn every deposited dollar into $8 in loans - go get deposits.

The top 3 banks in the country have over 40% of the deposits, the top 15 have over 74%. There are over 3,000 banks. So when I say “most banks are 1.0-1.25 LTD ratio” I am removing the bias of things like JP Morgan being at 44% LTD with over 16% of all US deposits. The money center banks are a different animal and make their money in different ways than regional banks.

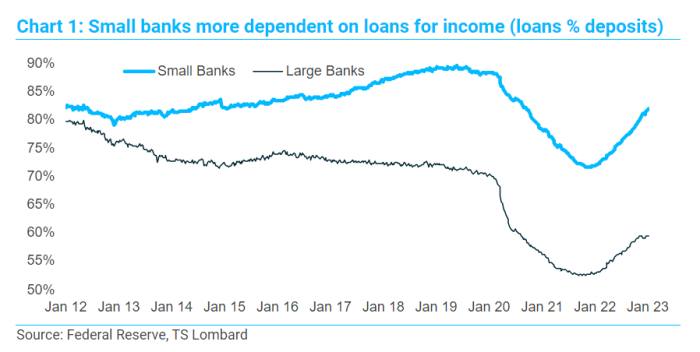

"Loan demand has not kept up with the increase in deposits, causing the industry’s loan-to-deposit ratio to sink from about 80% at year-end 2019 to 63% in mid-2021. Community banks have fared a little better: The loan-to-deposit ratio fell from 85% at year-end 2019 to 74% at mid-year 2021. Community banks typically aim for an 80% to 90% loan-to-deposit ratio because yields on loans exceed those of other assets, like investment securities."

Can't keep a job??? Maybe if you understood loan to deposits you'd still be at one of those stops...

You were exposed as the liar you are when you attempted to convince everyone that the "the govt forced financial institutions to not verify income of loan applicants" and that "JP Morgan didn't own the companies they are being fined over". You were schooled on both those statements.Don’t be Extra trying to think he could school me on the mortgage crisis when I lived the mortgage crisis from the inside and he didn’t.

^^^lying again^^^You were exposed as the liar you are when you attempted to convince everyone that the "the govt forced financial institutions to not verify income of loan applicants" and that "JP Morgan didn't own the companies they are being fined over". You were schooled on both those statements.

You really suck at using the quote feature.^^^lying again^^^

And what you are missing in all your reading - the market was flooded with cash in 2020 and 2021. Vast amounts of government printing of dollars, handed out like candy on Halloween. Those dollars were hoarded and have temporarily thrown the market out of historic norms.

For example, the “little” bank I was working for at that time made over 9,000 PPP loans. At least 60% of those weren’t really needed. I had one customer qualify for $3,000,000, never used a penny on it, didn’t have to pay it back, so his deposits simply grew by $3,000,000 overnight. You didn’t have to prove your business was impacted for round one PPP, you just had to prove you used it for payroll. So you paid your payroll with those dollars and kept the dollars that would have normally made payroll.

Multiply that single example by tens of thousands and you have hundreds of billions of deposit growth at a time when nobody was borrowing money.

So reality is looking back at 2019 on your graphs where “small banks” were averaging 90%. Then you have to understand that “small” to the Fed is generally considered banks under $100 billion in assets. Then you have to realize that 90% of those small banks are under $10 billion in assets, but 80% of small bank assets are held by the top 10% of those small banks. There are 2,250 banks in the US under $10 billion in assets.

So if you break down “small banks” and look at the 90% average, which is weighted based on assets, and understand as I said earlier, that smaller means a higher reliance on loans, you will understand that to get the 90% average the vast majority of small banks will have a loan to deposit ratio that exceeds 1:1.

If you have 1 bank with $100 billion in asset at a .7 ratio, you need 20 $5 billion banks at a 1.1 ratio to get a .9 average.

So again - most banks, in normal times, will have a ratio over 1. Just like in normal times meth heads don’t get mailed extra checks to not work.

Again, posting a link and understanding it are not the same thing.

Try that Control+C again, brother.^^^lying again^^^

Well, if you do your diligence, you call your bank and ask them what their tier 1 ratio would be once full impairment of held-to-maturity securities were factored in. In the case of People’s, their ratio is 11.92 before and would be 8.2 fully loaded. Anything over 6.5 is considered “well capitalized”.

We once had a poster (Plusfan ?) that would manually type out links because he was not aware one could copy./paste text.Try that Control+C again, brother.

This is why Black Mirror had to take a break, how can they keep up?

Damn shame I wasn't quoting him.You really suck at using the quote feature.

Greed is the only one that can handle using it this way. DamnTry that Control+C again, brother.

Damn shame I wasn't quoting him.

Greed is the only one that can handle using it this way. Damn

Maybe we should bust up banks who become too big to fail.The more that comes out about the SVB bailout, the more infuriating it gets.

https://www.newsweek.com/janet-yell...ality-americans-money-amid-bank-panic-1788353

Maybe. I’m not necessarily against big banks but SVB certainly makes a strong case for it. I think the Fed should be on the chopping block as well. The Intercept is doing some pretty good reporting on their failures - along with politicians like Newsome & Franke who are clearly acting in extremely shady ways.Maybe we should bust up banks who become too big to fail.

THEY HAVE TO LEVERAGE!!! Christ. It’s not that hard to understand.but you’d think there’d be, like, business centered banks that don’t leverage the money like this and expose themselves to this risk.

WrongLoans to deposits can't be above 100% or you'd have an insolvency issue.

They have to leverage to make money, I get that. In an alternate reality where the FDIC weren’t out here deciding who is too important to fail I think you might see some businesses willing to pay a fee to do their banking at a bank that doesn’t leverage as much and is less prone to being wiped out by a run.THEY HAVE TO LEVERAGE!!! Christ. It’s not that hard to understand.

It’s how banks make money. It’s called fractional reserve banking for a reason.How can a bank loan out more money than they have in deposits to loan out?

they have to leverage to pay interest to depositors. They have to leverage to counter the amount of deposits they are holding. Deposits are a “liability” on the balance sheet. It’s simple accounting.They have to leverage to make money, I get that. In an alternate reality where the FDIC weren’t out here deciding who is too important to fail I think you might see some businesses willing to pay a fee to do their banking at a bank that doesn’t leverage as much and is less prone to being wiped out by a run.

Or maybe human greed simply knows no bounds.

It’s actually more than that when you look at how that leveraged amount is also leveraged on across the financial system.That calculates out to a loan to deposit ratio of 800%.

It’s how banks make money. It’s called fractional reserve banking for a reason.

they have to leverage to pay interest to depositors. They have to leverage to counter the amount of deposits they are holding. Deposits are a “liability” on the balance sheet. It’s simple accounting.

Wrong

The major mistake is SVB didn’t hedge their hold to maturity bond position. Had they hedged appropriately they would have been fine despite the interest rate increases.Yes. I was oversimplifying and using absolutes, both of which aren't good things to do. I could and should have phrased that differently.

The thing that we all should be able to agree on is this is a complex situation that defies conventional wisdom in many aspects. One thing for sure is the Fed raising rates, and quickly, hasn't done anything to help banks' liquidity.

We all look at things differently and I come from an accounting, finance and operational background and not a banking background. That said I look at SVB's 12/2022 balance sheet and see $16 billion in impaired held to maturities and also see a 2022 net income of $1.5 billion. That's 10 years of profits sitting as a disclosure that would effectively wipe out 90% of the balance sheet equity, the basis for the leverage you referenced.

Seriously though I welcome your comments and analysis of what I have posted in this reply.

I like you, but you’re out of your depth.

When you have sat in asset allocation committee meetings at several regional and community banks we can discuss things further.

Multiply that single example by tens of thousands and you have hundreds of billions of deposit growth at a time when nobody was borrowing money.

So again - most banks, in normal times, will have a ratio over 1.

The major mistake is SVB didn’t hedge their hold to maturity bond position. Had they hedged appropriately they would have been fine despite the interest rate increases.

Well isn't this just the forum full of bankers. I knew we had a few didn't realize so many. InterestingI like you too but I have professionally analyzed dozens of banks over the last 15 years and do look at things a little differently from those actually in the banking industry. These have all been community banks ranging from $150 million in deposits to $5 billion. One thing I have seen in many of the smaller banks has been loan to deposits in the 30% - 40% range. When told they need to improve, they struggle to get out of their comfort zones and seem to plateau in the mid to high 60's.

The highest LTD ratios I have personally seen are high 80's to low 90's.

With LTD ratios over 100% how much discretion in asset allocation do you have? Honest question - not a gotcha. Obviously with SVB's 40% there was plenty of discretion. What could or should they have done differently.

See my comment about SVB's $15 billion in impaired held to maturities with $16 billion in equity. That and the $1.6 billion in realized losses. How much of an effect did that have on depositor confidence?

I agree 100%.

I know banks do, mainly well capitalized, but I have never personally seen it. And the averages since 1984 just don't seem to support that assertion.

U.S. Banks: The Haves And Have Nots Part 1

Rising rates is a game-changer for many U.S. banks. See why I always prefer banks with sticky, low-costseekingalpha.com

1984 - 2022

"The first chart shows the industry's aggregate loan-to-deposit ratio by quarter from 1984 to Q2 2022."

- Historic average: 81%

Well isn't this just the forum full of bankers. I knew we had a few didn't realize so many. Interesting